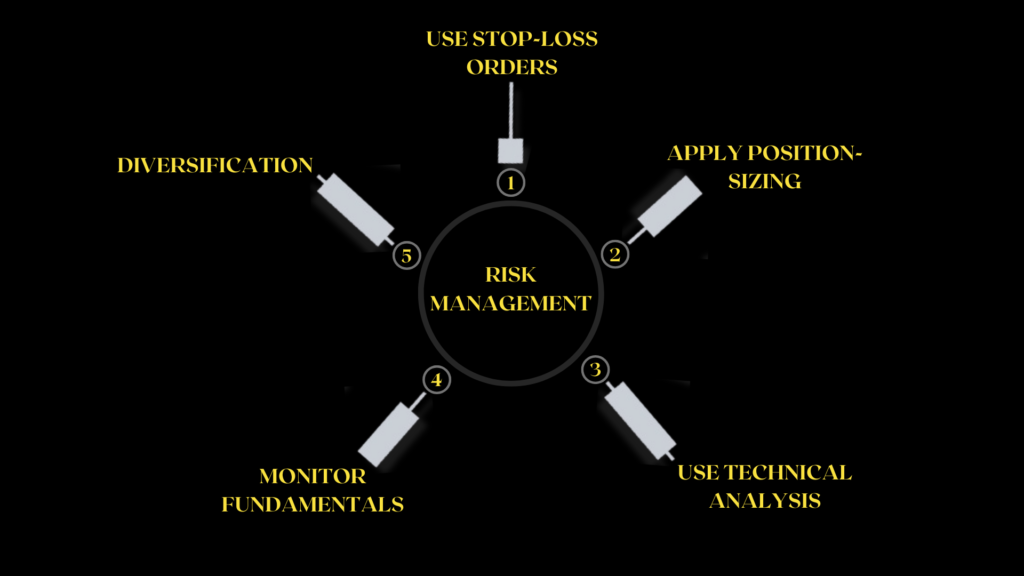

Forex Trading Is A High-risk Activity That Can Lead To Massive Losses If Not Managed Properly. Therefore Risk Management Is An Essential Aspect Of Forex Trading That Every Trader Must Master. Here Are Five Different Ways For Risk Management In Forex Trading That You Can Employ To Minimize Your Risk Exposure.

- Use Stop-Loss Orders

A stop-loss order is a pre-determined price level at which a trader will exit a trade to limit their potential losses. By setting a stop-loss order, a trader can prevent losses from accumulating beyond a certain point. This technique is useful in volatile markets where prices can change rapidly, and sudden moves can blow up trader’s entire account.

- Apply Position Sizing

Position sizing (lot size) is a risk management technique that involves adjusting the size of a trade to reflect the trader’s risk tolerance. In other words, a trader will only risk a certain percentage of their trading account on any one trade. This approach ensures that traders do not put too much of their capital at risk, which can lead to losses if market manipulated.

- Use Technical Analysis

Technical analysis is a risk management tool that involves using charts and other technical indicators to identify potential market movements. By analyzing price patterns and technical indicators, traders can identify areas of support and resistance and determine when to enter or exit a trade. This technique can help traders avoid taking on too much risk by ensuring that they only enter trades when the risk-to-reward ratio is favorable.

- Monitor Market News (Fundamental Analysis)

Forex trading is heavily influenced by economic and political events, and traders must stay up-to-date with the latest news and developments that can impact currency prices. By monitoring market news, traders can anticipate potential market movements and adjust their trading strategy accordingly. This technique can help traders avoid taking on too much risk by ensuring that they only enter trades when the market conditions are favorable.

- Diversify Your Portfolio

Diversification is a risk management technique that involves spreading investments across different markets, sectors, and currencies. By diversifying their portfolio, traders can reduce their overall risk exposure and minimize the impact of any one market event. This technique can help traders avoid taking on too much risk by ensuring that they have exposure to a range of markets and currencies.

In conclusion, forex trading can be a profitable venture, but it also carries a significant risk. Traders must, adopt a risk management strategy that suits their trading style and risk appetite. By using stop-loss orders, position sizing(lot szie), technical analysis, monitoring market news, and diversifying their portfolio, traders can reduce their risk exposure and increase their chances of success in the forex market.

Solution for this: You can join our Free Signals channel where you will get Risk Management Tips for Free not only that you will get access to 62+ EBOOKS related to Forex Trading so you will learn to self master forex while getting profitable with us for FREE!